| Sector | Specific Business Need/Crisis | Annual AV Market Potential (2024-2030 CAGR) |

|---|---|---|

| Maritime terminals | Continuity and safety | $12B (17.49% CAGR) |

| Yard Logistics | E-commerce Velocity, High Labor Turnover | $2.5 Billion (15.6% CAGR) |

| Mining | Labor Scarcity, Extreme Safety Risk, Remote Operation | $11.2 Billion (15.3% CAGR) |

For years, the world’s attention (and billions of investment dollars) has been fixed on the promise of Autonomous Vehicles (AVs). At the dawn of 2026, the dream has become a reality with Robotaxis logging millions of driverless miles, navigating complex urban chaos, and carrying real passengers, and with driverless trucks making both long-haul and middle-mile trips.

While these first AV use cases have made huge progress, mass-market adoption and profitability are still a few years away. The good news is that there are additional use cases where Physical AI can be applied.

A yet untapped commercial AV opportunity lies in automating the critical operations that underpin the global economy. If a vehicle can safely navigate a crowded city street, it can certainly automate repetitive, mission-critical tasks in the controlled environments of ports, mines, and logistics yards. What’s interesting is first that these cases are driven by a pressing operational and business need. Second is that the regulatory and operational domains are not as complex as people movers on public streets.

Why is this distinction important? Because it means that once AVs prove themselves in these scenarios – once the chasm is crossed – the uptake will be fast, as will the ROI.

The Operational Crisis Driving Automation

The adoption of Industrial Autonomy in ports, mining, agriculture, and logistics is a necessary response to four deep, systemic pressures that threaten global supply chains and output. For these companies, automation is a crucial investment in maintaining stability and achieving growth, not a marginal cost-saving exercise.

Labor Scarcity and Continuity:

Workforce shortages across heavy industry, combined with a significant wave of retirements, mean organizations are struggling to staff essential 24/7 operations. An absence of a key operator can halt multi-million dollar production cycles.

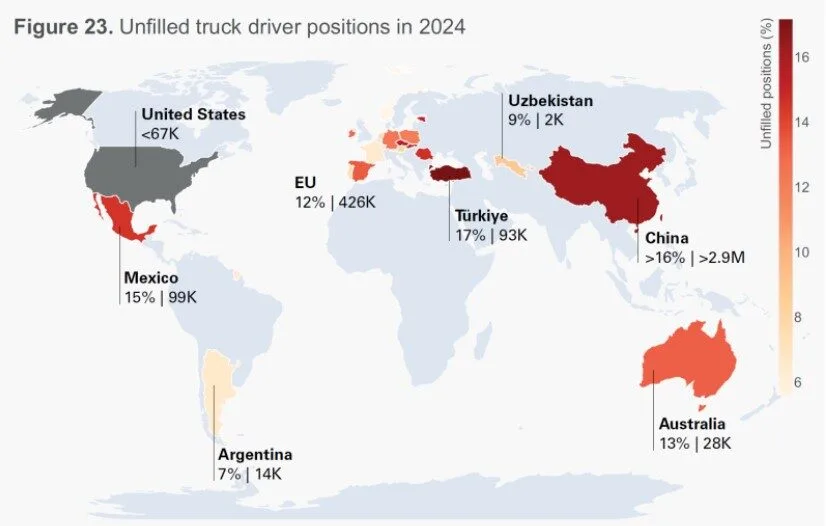

According to the IRU, there is a global shortage of 3.6 million truck drivers (across 36 member countries). What’s more, this is a long term issue as 3.4 million drivers will retire by 2029, with fewer young drivers to replace them.

Efficiency and Throughput Limits:

Autonomous systems, by maintaining continuous 24/7 operation and optimal driving profiles, eliminate these bottlenecks.

Studies indicate that automated haulage systems in mining can improve overall efficiency by as much as 30 percent compared to traditional fleets, primarily through uninterrupted cycles and logistics optimization.

Safety and Liability Management:

Industrial sites are inherently high-risk environments. Removing human personnel from the immediate vicinity of heavy machinery and introducing advanced safety algorithms addresses key safety and liability risks.

Example: Construction remains the sector with one of the highest number of fatalities in the U.S., emphasizing the immediate safety value of deploying autonomous operations in critical zones. (Source: OSHA-related analysis of 2024 data).

ESG Compliance and Fuel Optimization:

Optimized, automated driving avoids the aggressive acceleration and braking associated with human driving, which significantly reduces wear-and-tear and minimizes fuel consumption and emissions. This provides a measurable path for operators to meet mandated ESG (Environmental, Social, and Governance) targets.

Studies indicate that optimized fleet management and autonomous driving can reduce fuel consumption by 11% to 30%.

The Technical Reality: It’s Not “Easier”, Just Different

What sets these environments apart is a constellation of structural traits that align perfectly with current technology maturity, enabling deployments that deliver reliability and ROI far sooner than in open public domains.

Constrained industrial sites, from fenced container terminals to demarcated mine haul roads, inherently feature bounded operational design domains (ODDs) with clear geographic perimeters that simplify high-definition mapping, geo-fencing, and safety validation processes.

Workflows here are repeatable and structured, minimizing the chaos of urban driving. This rhythm allows autonomy stacks to master a finite set of maneuvers with exceptional precision.

It is a common misconception that geofenced industrial environments are “easier” than public roads. They are, in fact, harder in different, more consequential ways. The complexity shifts from avoiding random pedestrians to managing dynamic, mission-critical environments with zero tolerance for downtime and with need for precision localization – sometimes to the level of one centimeter.

Which markets represent a Multi-Billion Dollar Opportunity for Physical AI?

The next big market opportunity in Autonomous Vehicles is centered on Operational Autonomy – the automation of repetitive, heavy-duty vehicle tasks within constrained, high-value industrial environments. There are several distinct multi-billion dollar markets that suffer from efficiency, continuity and labor challenges, and which AVs can solve.

These levers coalesce into a compelling resilience ROI, hardening revenue and margins against disruption.

Critically, they operational crisis discussed position these markets to “cross the chasm” per Geoffrey Moore’s landmark framework: once early adopters, such as leading terminal operators and Tier-1 mining operations – validate feasibility and economics through pilots, mainstream uptake accelerates dramatically, propelled by peer proof and standardized integrations.

Measurable KPIs like moves-per-hour, haul cycles, yield preservation, and delay reduction enable fast ROI realization, often within 2-3 years via compounded labor savings and throughput gains.

| Sector | Specific Business Need/Crisis | Annual AV Market Potential (2024-2030 CAGR) |

|---|---|---|

| Maritime terminals | Continuity and safety | $12B (17.49% CAGR) |

| Yard Logistics | E-commerce Velocity, High Labor Turnover | $2.5 Billion (15.6% CAGR) |

| Mining | Labor Scarcity, Extreme Safety Risk, Remote Operation | $11.2 Billion (15.3% CAGR) |

| Agriculture | Optimal Timing, Precision, Field Labor Shortage | $15 Billion (21% CAGR) |

The next big AV market: operations focused autonomy in constrained environments

Autonomy has evolved into a business-critical solution for continuity in high-stakes constrained environments perfectly matched to today’s proven technologies. As value proves in beachhead adopters, the chasm-crossing dynamic ensures rapid, scaled proliferation across ports, logistics yards, agriculture, and construction.

Autonomous Vehicles for operations is resilient infrastructure that delivers fast returns while anchoring global industrial operations for decades ahead.

For follow up reading on real Physical AI technology that addresses a real business problem in container ports, have a look at our Autonomous Terminal Tractor Retrofit Kit.