The global transportation and logistics industry is facing a multitude of interconnected challenges that lead to rising volatility and costs across the supply chain. One of the ways companies are working to meet these challenges is with technology and automation. Autonomous vehicles are emerging as an important part in the efforts to stabilize and improve the efficiency of supply chains.

Supply Chain Challenges in 2024

Rising consumer demand, driven by economic recovery and shifting consumption patterns, is straining logistics networks. This increased pressure exacerbates existing issues and creates new hurdles for the industry to overcome.

Geopolitical tensions, particularly ongoing conflicts in Eastern Europe and the Middle East, continue to disrupt traditional trade routes and energy supplies. These disruptions force companies to reassess their logistics strategies and seek alternative pathways, often at higher costs and with longer lead times.

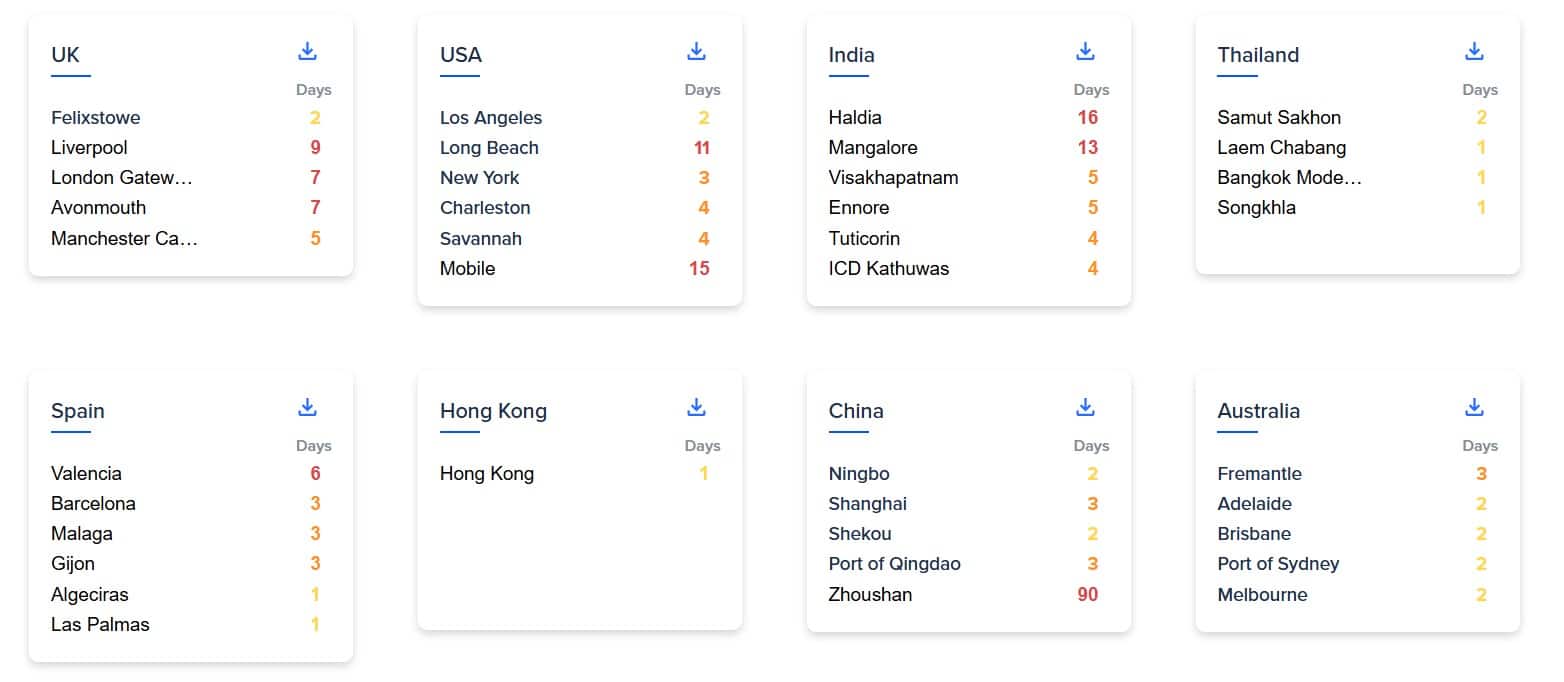

Sample port delays, November 2024

Climate change-induced extreme weather events pose substantial risks to supply chain reliability. More frequent and severe events lead to port closures, infrastructure damage, and transportation network disruptions, causing unpredictable delays and increased insurance costs.

Volatile fuel prices add another layer of uncertainty to operational costs, while ESG regulation on carbon emissions adds long-term pressure on capital investment

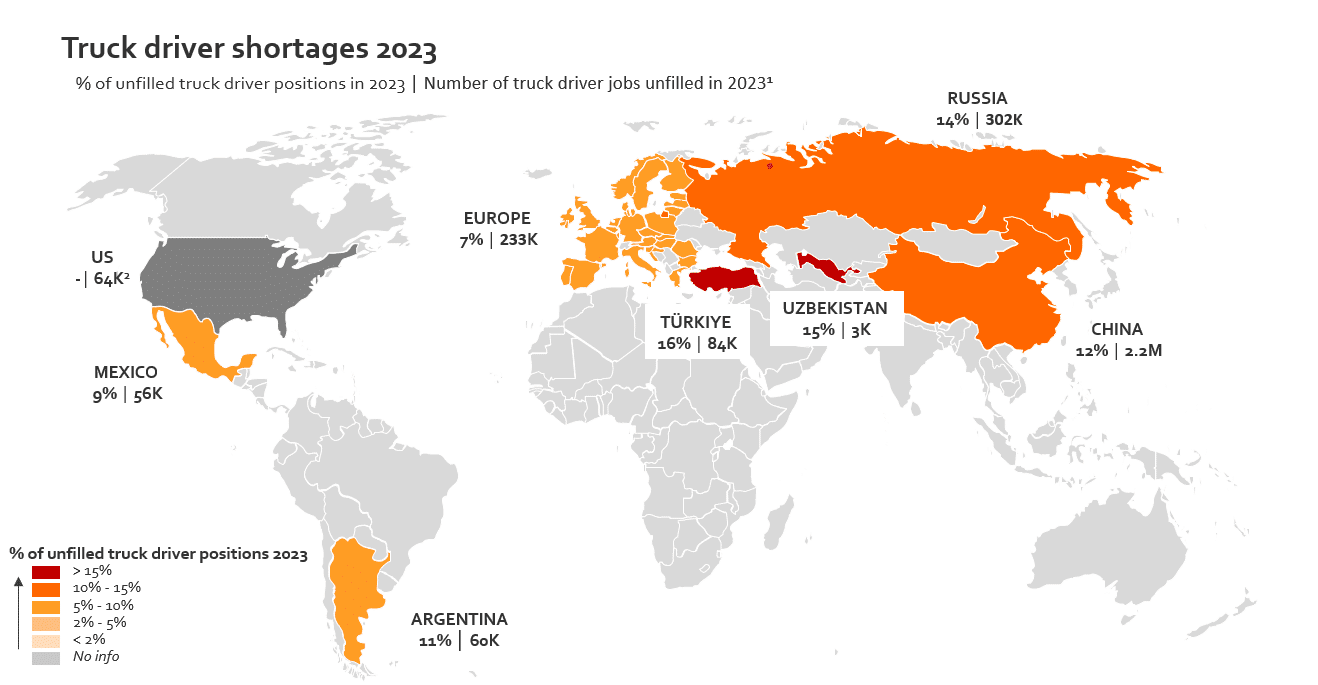

Last, but not least, persistent workforce shortages, particularly for drivers and logistics workers, further complicate the situation. The aging of the existing workforce and difficulty in attracting and retaining new workers drive up labor costs, reduce productivity, and lead to delays.

Source: IRU

Driving Efficiency: The Role of Autonomous Vehicles Along the Supply Chain

The transportation and supply chain industry is turning to digitization, automation, and autonomous solutions to address the challenges it faces. These technologies can alleviate labor shortages, improve efficiency, increase predictability, reduce costs, and enhance safety.

Autonomous vehicles (AVs) are emerging as a particularly promising option. For instance, self-driving trucks are being developed to address the chronic driver shortage and improve long-haul and middle-mile efficiency. Automated terminal tractors (ATTs) boost port productivity and In warehouses, autonomous mobile robots (AMRs) streamline inventory management and order fulfillment processes. Last-mile delivery is also being disrupted by autonomous delivery robots in urban environments.

AVs help solve several challenges, including mitigating labor shortages, reducing labor costs, improving safety by minimizing human error, enabling 24/7 operations, and enhancing overall supply chain efficiency. Additionally, they can accelerate the transition to electric-powered vehicles, enable optimized routing and driving patterns, and even reduce traffic congestion with small, optimized form factors.

Here are some examples of how Driverless Vehicles are being used in different ways throughout the supply chain:

Autonomous Long Haul Trucks

The primary use case involves self-driving trucks operating on highways, with human drivers handling the first and last-mile portions of the drive. This approach aims to maximize efficiency on long stretches of relatively predictable road conditions while addressing complex urban environments with human expertise.

The benefits of AV in long-haul trucking are substantial. These systems can operate nearly 24/7, significantly increasing truck utilization compared to human-driven vehicles limited by hours-of-service regulations. TuSimple reports that their autonomous trucks use brakes less frequently than human drivers, leading to a 10% improvement in fuel economy.

Additionally, AVs offer steadier driving with less side-to-side movement, further enhancing efficiency and reducing tire wear.

Some sample deployments:

Kodiak Robotics has signed several commercial agreements and is leveraging partnerships with logistics giants to create a comprehensive autonomous shipping ecosystem, potentially revolutionizing the way goods are transported. Partners include 10 Roads Express, CEVA Logistics, C.R. England, Loadsmith, Maersk, and Werner Enterprises, Martin-Brower, and Artur Express.

Kodiak operates truck ports at a Ryder System facility in Houston and a Pilot Co. travel center in the Atlanta area.

Aurora has partnered with Uber Freight to integrate its self-driving trucks into Uber’s logistics network.

Einride operates a transport service for GE Appliances, primarily focusing on the daily transportation of finished goods between GE Appliances’ manufacturing facility and its warehouse.

Middle mile

Middle-mile shipping, where goods are transported between distribution centers and warehouses, is crucial for maintaining efficiency and meeting delivery schedules.

These challenges differ from those in last-mile and long-haul logistics due to the specific nature of the routes and operations involved. Middle-mile logistics often involves frequent stops at multiple distribution centers or fulfillment hubs. Maintaining consistency and reliability in delivery times across these multiple stops can be difficult. Route optimization is an important issue.

Gatik: focuses on middle-mile automation by operating fixed, repeatable routes for B2B short-haul logistics. Their partnerships with Walmart and other retailers demonstrate how they are tackling these unique challenges by providing reliable and consistent autonomous delivery solutions. For example, Gatik’s operations have shown a 30% reduction in delivery times and increased operational efficiency.

Autonomous trucking also allows for more frequent deliveries and store replenishment, which can help reduce inventories and retail floorspace requirements

Udelv: Udelv’s Transporter vehicles are designed specifically for middle-mile logistics. By partnering with major retailers, Udelv has demonstrated significant improvements in operational efficiency and delivery reliability, with a 25% increase in efficiency and a 35% reduction in delivery time variability.

Last Mile Delivery

Who hasn’t seen the cute little delivery robots?

The last mile, notorious for its complexity and cost-intensity, often accounts for up to 53% of total shipping costs. What’s more, they are one of the key contributors to inner city congestion and pollution.

AVs offer a solution to navigate dense urban environments, unpredictable traffic patterns, and the ever-increasing demand for speedy deliveries.

AVs in last-mile logistics bring several benefits, including increased efficiency, reduced labor costs, and improved delivery times. They can operate 24/7, mitigating the impact of driver shortages and strict working hour regulations. Moreover, AVs contribute to sustainability efforts by optimizing routes and reducing emissions. Short routes and small loads lend themselves to the adoption of small form factors that help solve some of the issues (though have the potential to create others)

A study by McKinsey suggests that autonomous delivery vehicles could reduce delivery costs by up to 40%.

Several companies are making significant strides in this space:

Coco operates a fleet of remotely piloted electric delivery robots focused on food delivery. By replacing couriers in cars, Coco’s robots reduce greenhouse gas emissions and city congestion. In 2023, Coco expanded operations in Santa Monica, partnering with local restaurants to provide efficient and eco-friendly deliveries

Serve Robotics has partnered with Uber Eats to deploy up to 2,000 robots across multiple U.S. markets. In the past 18 months, Serve has seen an average month-over-month delivery volume growth of over 30%, completing tens of thousands of contactless deliveries in Los Angeles and San Francisco.

Warehouse Intralogistics

These intelligent machines navigate warehouses independently, performing tasks such as inventory management, order picking, and material transport. Unlike their less flexible counterparts AGVs (Automated guided vehicles), AMRs adapt to changing environments, making them ideal for dynamic warehouse settings.

The benefits of AMRs are multifaceted. They enhance productivity by working 24/7 without breaks, reduce error rates, and improve worker safety by handling repetitive or dangerous tasks.

AGVs vs. AMRs and ATTs:

The industry move from AGVs to AMRs highlights the key difference between traditional automation and autonomy:

AGVs lack the ability to sense their environment or integrate with it. They lack any form of adaptability or “intelligence”. AGVs operate along fixed routes performing fixed tasks. They require extensive investment in infrastructure and sterile environments to operate.

AMRs on the other hand sense their environment and integrate with Warehouse Management Systems (WMS), ERP systems, and other smart sensors and “things” in their vicinity. They are equipped with algorithms and AI that allow them to operate in heterogeneous environments and to adapt to changing business needs.

According to a 2023 MHI Annual Industry Report, 38% of supply chain leaders are already using robotics and automation, with adoption expected to reach 77% in the next five years.

There are numerous players in this field, both large global corporations and local players.

Autonomous Vehicles in Yard Logistics

Yard logistics face unique challenges such as complex maneuvering in tight spaces, frequent stops and starts, and the need for precise trailer positioning. One of the most pressing issues driving AV adoption in yards is the chronic shortage of skilled yard drivers, with the American Trucking Association reporting a deficit of over 80,000 drivers in 2021.

AVs offer increased safety, improved efficiency, and 24/7 operability. They help mitigate human error, reduce accidents, and optimize yard flow. For instance, autonomous yard trucks can operate continuously without fatigue, potentially increasing yard throughput by up to 30%.

Several companies are leading the charge in yard logistics automation:

Outrider: Specializes in autonomous yard operations, offering electric yard trucks and AI-powered software. In 2023, they partnered with PepsiCo to automate trailer moves at a Frito-Lay distribution center, resulting in a 50% reduction in yard truck idle time.

ISEE: Provides AI-powered autonomous yard truck solutions. In 2023, they deployed their technology at a major U.S. retailer’s distribution center, reducing average trailer move times by 25%.

Einride: Offers electric and autonomous trucks for both on-road and yard operations. They recently expanded their partnership with GE Appliances, deploying additional autonomous yard trucks at GE’s Kentucky facility and achieving a 15% increase in yard productivity.

Autonomous Terminal Trucks

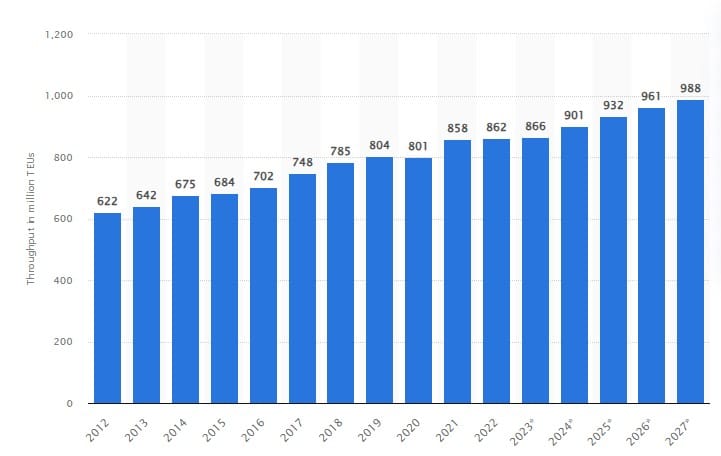

The surge in global trade, exacerbated by the pandemic-driven shift in consumer behavior towards e-commerce and rapidly evolving geopolitical hotspots, has led to unprecedented cargo volumes passing through ports.

World container port throughput (millions of twenty-foot equivalent units)

Source: Statista

Terminals face increasing congestion which, combined with other forces such as geopolitical crises that affect trade and extreme weather conditions, place a huge pressure on port efficiency. Large ports have been introducing automation and automation, but the process is slow and requires huge investment, limiting its benefits to the largest ports.

One of the bottlenecks in improving port efficiency is horizontal transport – the transportation of goods within the port. Here too, driver shortage creates bottlenecks that can be eliminated by deploying Autonomous Terminal Truck (ATTs)

A recent study by McKinsey found that automation could reduce operating expenses in terminals by 25-55% and increase productivity by 10-35%.

Several companies are at the forefront of this terminal transformation. Outrider, a leader in autonomous yard operations, has been making waves with its AI-powered yard trucks. In March 2024, they announced a partnership with BNSF Railway to deploy their technology at an intermodal facility in Kansas, aiming to improve container handling efficiency by up to 30%.

The Future of Supply Chains: Powered by Autonomy

As autonomous vehicle technology matures, it promises to revolutionize supply chains across all segments. From long-haul trucking to last-mile delivery, and from port operations to warehouse logistics, AVs will dramatically enhance efficiency, reliability, and sustainability. These innovations will mitigate labor shortages, reduce operational costs, and minimize human error. The integration of AVs will enable 24/7 operations, optimize routing, and significantly reduce carbon emissions. Ultimately, mature AV technology will create more resilient, flexible, and responsive supply chains, capable of meeting the ever-growing demands of global commerce while reducing environmental impact.